2025 Clothing Donation Tax Deduction. How to write off charitable contributions. If you aren’t taking the standard deduction , you will likely qualify for tax breaks for charitable donations and strategies that maximize them.

Charitable giving tax deduction limits are set by the irs as a percentage of your income. So, donating from january 1, 2025, to.

The result is your charitable contribution deduction to charity x can’t exceed $300 ($1,000 donation−$700 state tax credit).

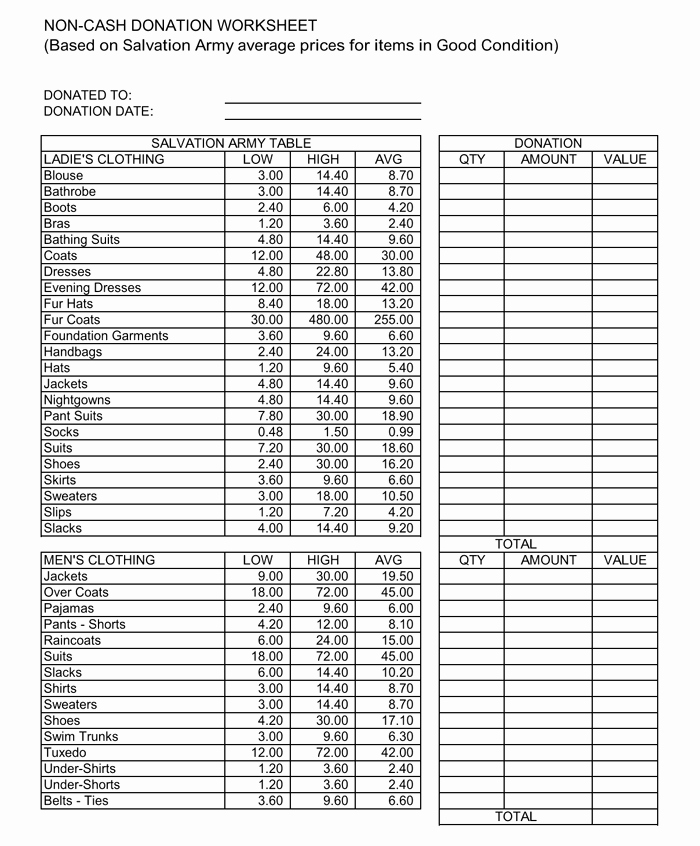

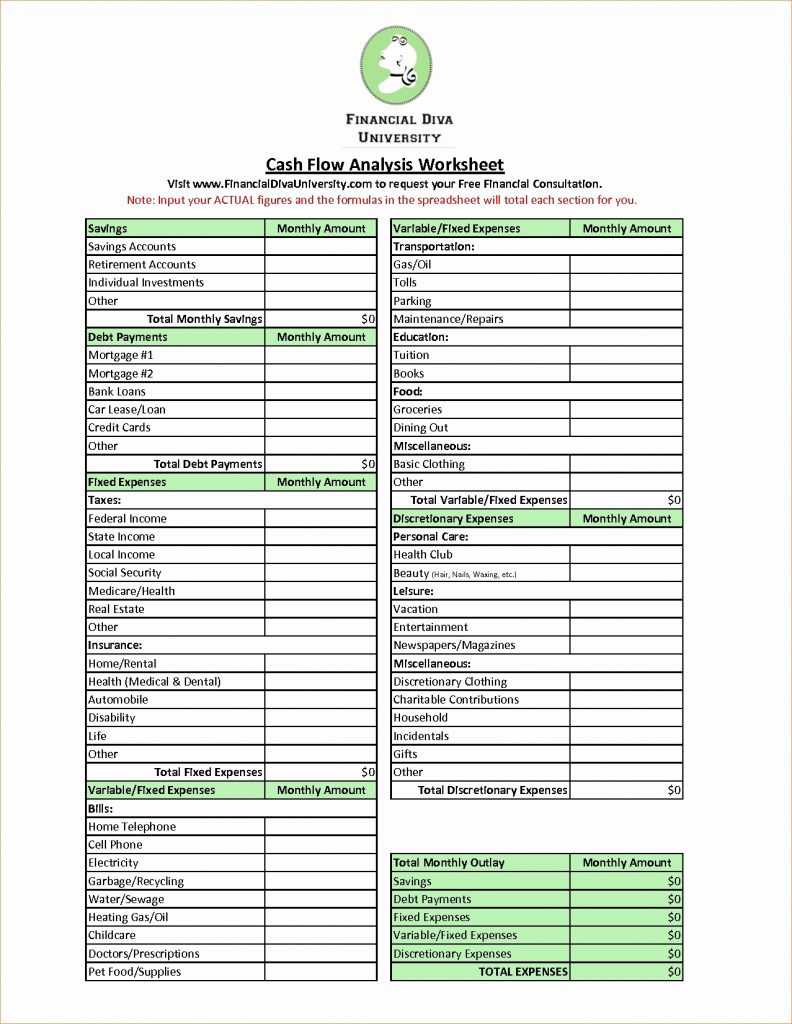

Irs Clothes Donation Worksheet, If you receive a donation, it might be subject to the federal gift tax, but you won't have to pay that tax. So, donating from january 1, 2025, to.

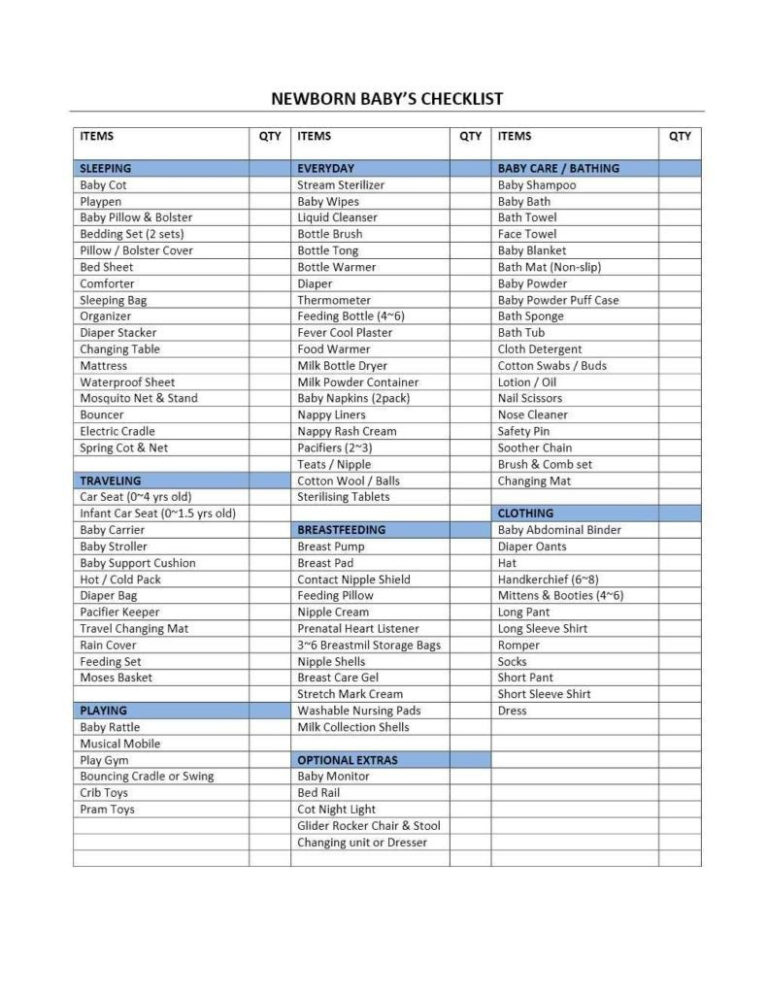

Tax Donation Spreadsheet with Clothing Donation Checklist 2017, You'll need to fill out this form if the. Specifically, december 31 marks the end of the year and the last day charitable donations count for that tax year.

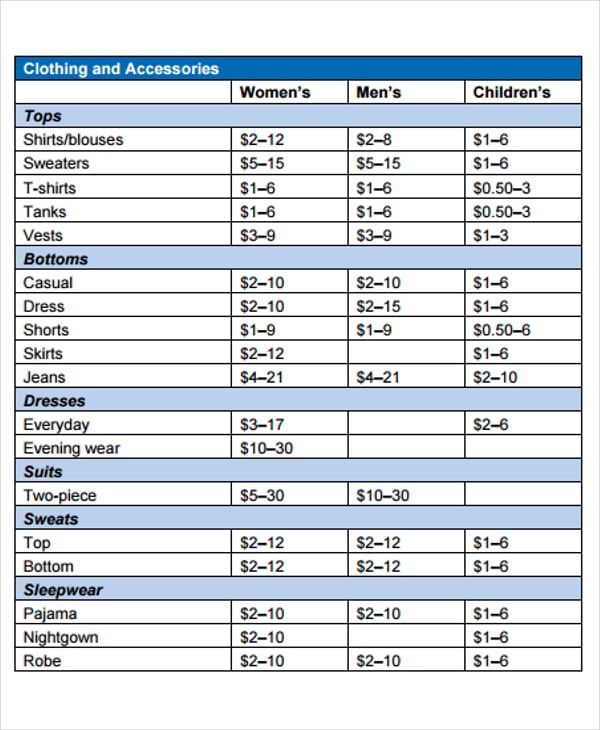

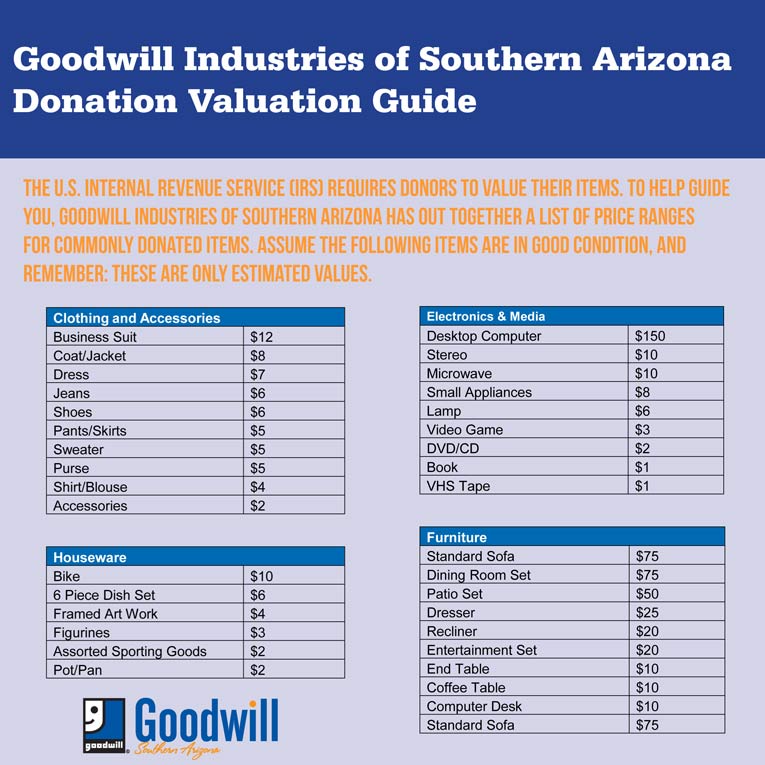

Printable Yearly Itemized Tax Deduction Worksheet Fill and Sign, Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2025 • october 19, 2025 8:39 am. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to.

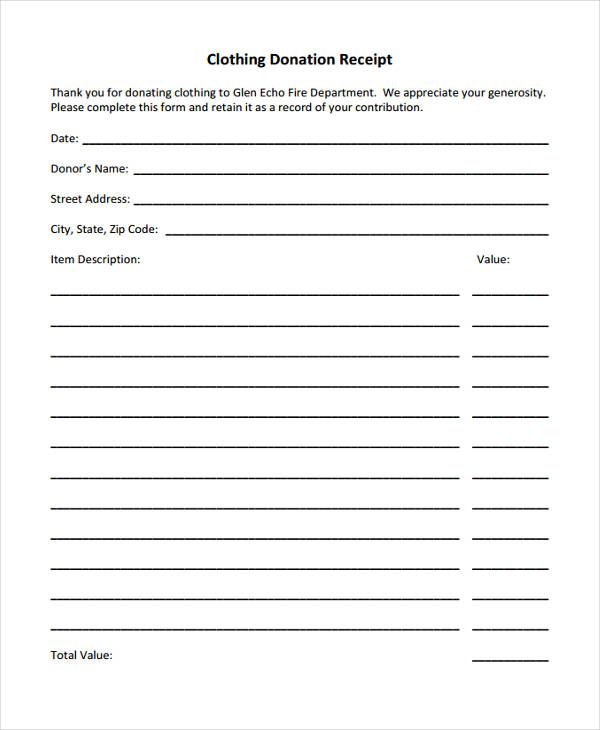

FREE 12+ Donation Receipt Forms in PDF MS Word Excel, It includes low and high estimates. Tax exemptions, on the other hand, are a set amount of income that is.

Inspiring Tax Receipt for Donation Template, It includes low and high estimates. How to write off charitable contributions.

50 Keep Track Of Charitable Donations, Single taxpayers and married individuals filing separately: Updated april 14, 2025 12:02 pm et.

Goodwill Donation Spreadsheet Template In Goodwill Donation Value Excel, The salvation army receipts reflect donated items totaling $11,779, consisting of clothing totaling $11,594 and a handful of household items. Updated april 14, 2025 12:02 pm et.

Clothing Donation Benefits, Tax exemptions, on the other hand, are a set amount of income that is. For example, you have until dec.

Tax Donation Spreadsheet Regarding Small Business Tadeductions, The reduction applies even if you can’t claim the state. To be eligible for tax deductions, the clothing donated must be considered as necessary and suitable for everyday wear or ordinary use.

Estimate the Value of Your Donation Goodwill Industries of Southern, To get any benefit from itemizing, your deductible personal expenses. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2025 • october 19, 2025 8:39 am.

Taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040).